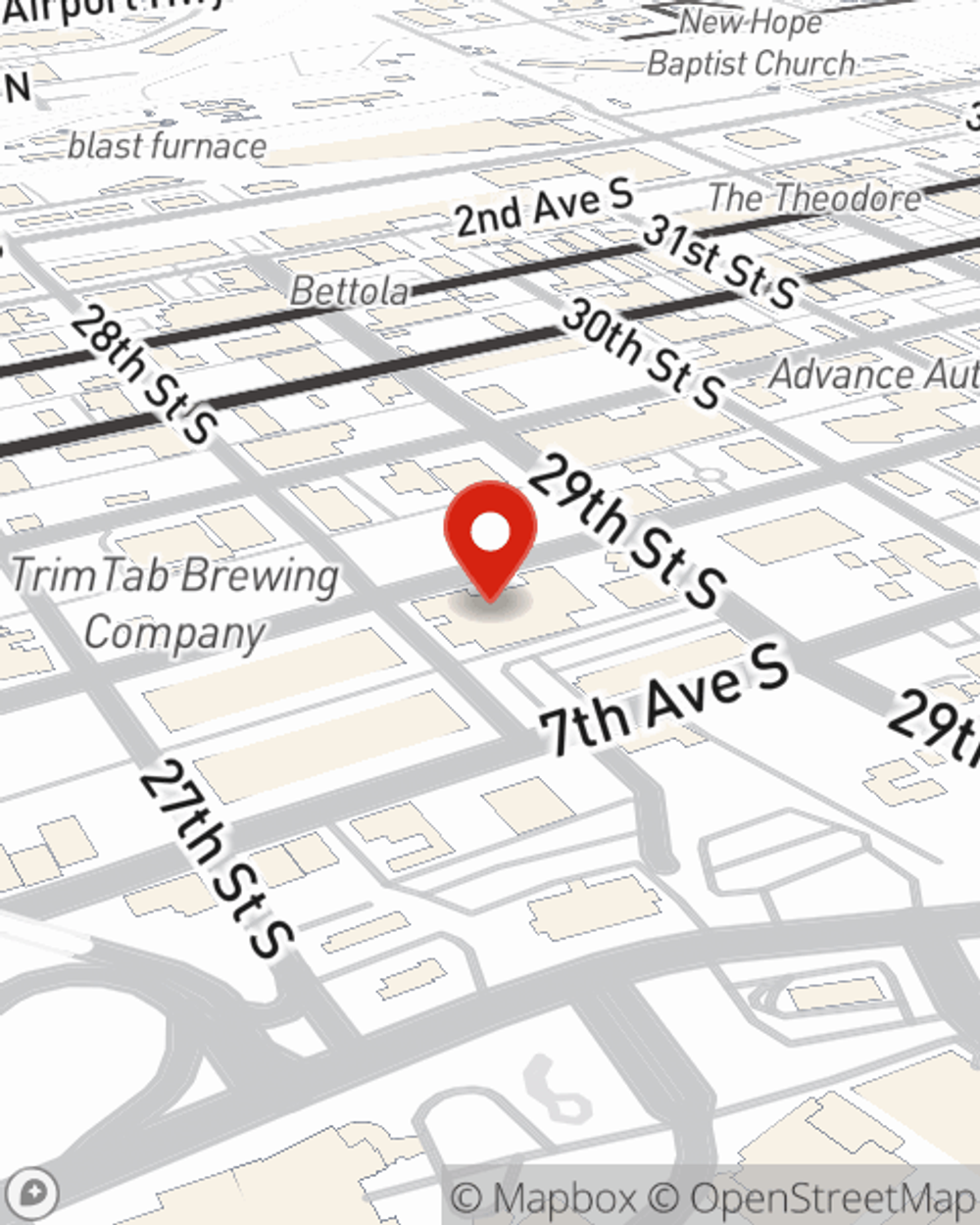

Business Insurance in and around Birmingham

Calling all small business owners of Birmingham!

No funny business here

- Birmingham

- Jefferson County

- Shelby County

- Mountain Brook

- Homewood

- Vestavia

- Cahaba Heights

- St Clair County

- Hoover

- Trussville

- Oak Mountain

- Inverness

- Gardendale

- Fultondale

- Leeds

- Moody

- Highland Park

- Huntsville

- Montgomery

- Atlanta

- Tuscaloosa

- Bessemer

- Irondale

State Farm Understands Small Businesses.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all alone. As someone who also runs a business, State Farm agent Caroline Dorris understands the work that it takes and would love to help lift some of the burden. This is insurance you'll definitely want to explore.

Calling all small business owners of Birmingham!

No funny business here

Strictly Business With State Farm

For your small business, whether it's a pet groomer, an auto parts shop, a shoe store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like buildings you own, business liability, and computers.

It's time to visit State Farm agent Caroline Dorris. You'll quickly recognize why State Farm is the reliable name for small business insurance.

Simple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Caroline Dorris

State Farm® Insurance AgentSimple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.